The Founder's Guide to Consumer App Monetization: Part 1

Deep dive into effective consumer monetization strategies

The Founder's Guide to Consumer App Monetization: Part 1

Deep dive into effective consumer monetization strategies

A few months ago, we explored how Indian media platforms are successfully monetizing users directly at scale, challenging the dated perception of India as merely an MAU/DAU farm. Today, we're diving deeper into how founders can build and monetize consumer applications effectively in this evolving era of monetization.

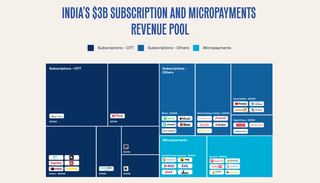

The ideal vision of a consumer business often seems straightforward: millions of users, high daily engagement, and a strong willingness to pay. However, the reality of building such businesses—especially in India—is more nuanced. As far as revenue streams for social/content businesses go, while digital advertising continues to dominate with a $8 billion revenue pool growing at 16-18% CAGR, we're seeing a significant shift in the monetization landscape. Subscriptions and micropayments have emerged as a $3 billion pool—a revenue stream that barely existed a few years ago! This transformation is particularly noteworthy as even consumers in Tier 2+ cities are now demonstrating a willingness to pay for value-added media services.

The current market structure tells an interesting story. While the top 5 OTT platforms control 50% of subscription revenue, it's the new-age Indian consumer businesses that have carved out their own space, dominating the emerging micropayments arena. This diversification of revenue streams suggests a maturing market ready for innovative monetization approaches.

The Changing Face of Indian Consumer Monetization

The Indian consumer has undergone a remarkable transformation and this juncture marks a pivotal point in the evolution of the digital consumption market. Throughout the 2000s and 2010s, the market was characterized by users who actively sought ways to avoid paying for content—whether through torrents for movies or native downloads for music than pay for premium streaming plans. Today, that same market is witnessing an unprecedented shift: users are actively choosing to pay for convenience and high-quality content. Through subscriptions, micropayments for services, digital assets etc., new-age companies are successfully monetizing users directly, opening up possibilities that were unthinkable just a few years ago.

Monetizing Early While Scaling Rapidly

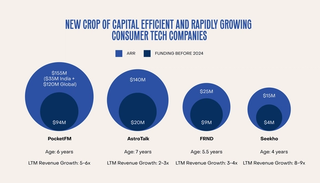

This evolution in consumer behavior has fundamentally altered the growth trajectory for a new wave of consumer tech companies. Unlike their predecessors who needed massive capital before seeing meaningful revenue, today's startups can get there much earlier in their journey and that too with much less capital invested. Companies like PocketFM, AstroTalk, Seekho, and FRND exemplify this—they've been able to scale up rapidly in a capital-efficient manner and unlock large revenue pools.

The Dawn of a New Playbook

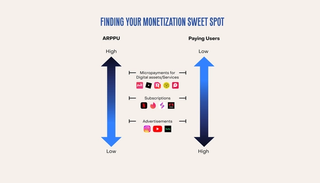

Companies looking to monetize effectively could either maximize the average revenue per paying user (ARPPU) or the absolute number of paying users. Our experience has revealed a consistent inverse relationship between realization potential per user and the percentage of users willing to pay, indicated by the illustration below.

Companies with high-priced or frequently purchased offerings can unlock large revenue pools even with a smaller paying user base. Conversely, business models targeted at a larger universe of users can afford to work with lower realization per user.

This inverse relationship manifests in distinct business models, each with its own merits and challenges.

1. High realization, small paying userbase businesses have high ARPPUs (usually due to high frequency of purchases) but high churn rates as well. Businesses like PocketFM, ReelShort and AstroTalk have pay-per-use models and see the occurrence of ‘whale behaviour’, where <5% of the user base is retained, but they stick around for a very long time and end up accounting for >90% of the revenue.

2. Mid realization, mid paying userbase businesses usually adopt monthly payment plans to directly monetise a certain percent of their user base. These are usually subscription models that could either be fully paid (like Netflix) or freemium (like Tinder).

3. Low realization, large paying userbase businesses are usually free-to-use platforms that monetize users’ time spent on the platforms. Platforms like Instagram and YouTube have very high DAU and daily session times, which make them easier to monetize at lower ARPU but on the entire user base through advertisements.

Looking Ahead

It is important to note that whilst the inverse spectrum of ARPPU and Paying Users can serve as a benchmark, it might not always hold true. We believe that businesses may prioritize different parts of the equation (pricing, frequency of purchase, paying percentage, etc.) to monetise most effectively. While making these decisions, the Life Time Value (LTV) that can be derived out of a user should be looked at in conjunction with the Customer Acquisition Cost (CAC) to ensure healthy unit economics alongside driving growth.

In Part 2 of this series, we'll explore specific monetization models — micropayments, subscriptions and advertisements. We'll examine how to choose the right model based on your business characteristics, supported by real-world case studies and benchmark metrics across different business stages.

Written by Manish Advani

Related

Harnessing Better Experience And Innovative GTM: Marketplaces Unleashed Part 3

Exploring the last two pillars of our marketplaces framework through case studies

03.08.2023

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Atlys

Building the world’s largest digital visa provider

21.09.2023