Paytm - Digitising Bharat

2007

The Beginning

Our partnership with Vijay Shekhar Sharma began in March 2007. India was beginning to fall in love with mobile phones back then as call rates had dropped to under INR 1 / minute. The company was called One97 Communications and aimed to become a dominant player in the Indian telecom market by partnering with content creators for mobile VAS (value-added services) and owning the ability to deliver it.

Unlike the usual archetype of founders

who pitched to us back then, Vijay did not have an IIT degree or multiple years of corporate experience under his belt. However, his raw energy levels and passion for the business made him stand out and we couldn't resist investing. Vijay was extremely ambitious and obsessed about owning the distribution of content to telecom subscribers. He had also been through tough times in the past and demonstrated great resilience. Both of these ingredients were extremely critical in our view for building a long-lasting institution in a tough market like India.

One97 marched on steadily for the next 2 years and had started generating free cash every month.

The company had more capital in the bank than they had raised and was quite comfortably placed. However, Vijay still felt a gap in his personal ambition and wanted to create a B2C platform that could have an order of magnitude higher impact and scale as compared to the B2B2C / B2B approach that One97 had historically taken. B2C products of that scale had thus far been created only by international companies and Vijay wanted to prove that Indian companies had the capability to create similar products that could be used by hundreds of millions of Indian citizens every day.

By then, there were ~400M mobile phone subscribers in India, and ~3% of them were using the internet on their mobile devices.

Vijay realized that as mobile internet and smartphones find adoption in India, telecom operators will start losing their grip on the customer and the fundamental technology stack would go through a change. He then started exploring all possible opportunities ranging from creating Android devices to building an app store to creating an advertising ecosystem. The eureka moment came on a trip to the US when Vijay made his first purchase on the iOS App store and realized that if smartphones were to be successful in India, it would be contingent on the success of apps, which would again be contingent on a payment system for apps. He then started researching the current payment stacks for debit cards, credit cards, and net banking in India and realized that most of them were clunky and not best suited for the smartphone era.

The vision for Paytm, which stood for Pay Through Mobile, thereafter started taking shape.

When Vijay pitched this idea to the board for the first time, he encountered quite a lot of skepticism. The questions posed ranged from why would India suddenly start adopting online payments and move away from cash, to why is this the right time to build the business because the cheapest smartphone is still sold for $400-500 which is too expensive for India, to even if this vision was true, why would the current team that has historically focussed on B2B technology be best placed to build a consumer tech business which requires large investments in marketing and brand building. The board meeting ended with no confirmation of Vijay's plans but he continued to believe that this was a once in a lifetime opportunity, so much so, that he was even willing to put his equity on the line to do this.

Birth of Paytm

There is no fun in doing what others ask you to do. The real fun is in doing what people say you can’t do.

Vijay Shekhar Sharma, founder & CEO, Paytm

It is with this belief that the first version of Paytm was launched in August 2010

One of the core ingredients for Paytm’s success over the years

has been their relentless focus on understanding the Indian consumer’s tastes and preferences and doing whatever it takes to give them the best possible user experience. Even before the roll-out of Paytm, the company built out 24X7 customer care to address the worries of customers and to help build trust that enables them to put their money in the hands of the unknown.

"We propagated through word of mouth once the trust was built. I have a firm belief that the truest relationship test comes when one goes through a stressful situation. Trust is the secret formula that worked for us, though there were 30 other players in the market."

Vijay Shekhar Sharma, founder & CEO, Paytm

The idea behind Paytm wallet

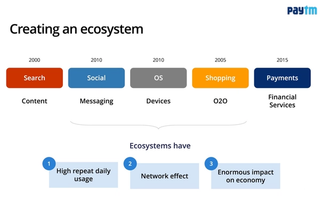

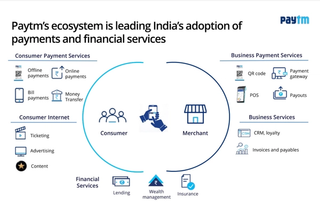

also came through an observation made by the customer support team. Back in the days, when consumers were using Paytm to recharge their phones etc., whenever payments failed, it would take 4-5 days for the money to get refunded back to them. In this period, the customer would get extremely worried because they thought they had lost their money and sent multiple messages expressing their dissatisfaction to customer care. One of the team members then suggested that to gain customer confidence, Paytm should show this balance on the app to the customer even if the company hadn’t received the money back yet. This ended up becoming version 1 of the Paytm Wallet. A few months later, Paytm hired a product manager who introduced the idea of opening up the wallet to other merchants. One of the early adopters of this product was Uber India and from there on there has been no looking back. From that point Paytm has always thought of itself as an ecosystem business.

Paytm launches online merchant business

with Payment Gateway as its first product.

10M+ Paytm Users

Elevation introduces Paytm to Jack Ma

which eventually led to a $210M investment in Paytm by Ant Financial and Elevation

“Ravi doesn't write long emails and doesn't have passages of feedback. It's mostly one or two lines. The day I was going to meet Jack Ma for fundraising, Ravi wrote a long email to me for the first time, describing what I should speak about and what I should emphasize. It was like your elder brother sending his best wishes before an exam and reminding you how to do well.”

Vijay Shekhar Sharma, founder & CEO, Paytm

100M+ Paytm Users

Paytm launches QR codes

to enable cashless payments across offline shops

$480M raised

$480M raised from Alibaba and Ant Financial

Paytm launches Entertainment business

with movie ticketing as the first product.

Paytm Payments Bank launched

1M+ active merchants

$1B raised from Softbank

5M+ Daily Transacting Users

Berkshire Hathaway makes its first private tech investment

by investing $300M in Paytm

Paytm Money launched

Paytm launches PayPay in Japan

Launch of Paytm First Games

which now offers a rich portfolio of games and entertainment content including casual games, contests, and sports games.

$700M raised

from investors including Ant Financial, Softbank, T.Rowe Price and Discovery Capital

Paytm launches Insurance Broking

with a vision to offer bite-sized products at competitive prices to merchants and customers within the ecosystem

Paytm Money Launches Futures & Options Trading Feature

including stocks, direct mutual funds, ETF, IPO, NPS, and digital gold

Paytm crosses 1.4B Monthly Transactions

Paytm IPO Becomes India’s Largest Public Offering

This is still just the beginning

Paytm is on a mission to bring half a billion Indians into the mainstream economy through payments, commerce, and financial services.

Over the last decade, Paytm has also empowered millions of merchants with technology to help them run and grow their business efficiently.

Paytm today

We feel privileged to have partnered with Paytm where today,

337m

Total Consumers

Transacting through the app

7.4b

Plus total transactions

Have been conducted

947k

Total payments devices

Use the platform

22m

Total merchants

Enabled by Paytm

“Over the years, my relationship with Vijay has evolved from a typical investor relationship to a close personal friendship. Vijay is probably the most dynamic person I have ever met. He has more energy at 2 AM than most people have at 8 AM, and he is constantly thinking about new initiatives at Paytm. Vijay is also the best venture capitalist in India. Rather than being satisfied with the success of One97, he "bet the farm" to build Paytm. Very few founders would have made that call without hedging for themselves.

My biggest personal learning from Paytm is that you should never solely look at the initial TAM a founder is addressing. More often than not, the initial TAM is simply too small. A great founder will not only realize this early on but constantly look at ways to increase the TAM they are addressing.”