Future of Play: Building the Next-Gen of Gaming

Our thesis and spaces of excitement in gaming

Download our complete 'Future of Play' deck here

Gaming has rapidly become one of the most dynamic and fastest-growing content formats globally. It's staggering to think that ~40% of the world's population engages in gaming. The gaming market today is worth over $200 billion — more than double the combined size of the music and film industries. Games have become social experiences that have come to hold significant cultural relevance.

The evolution in this space is rooted in two main themes: improving access to gaming, which has brought more gamers into the fold, and increasing the longevity of games, which helps players stay engaged. This aspect has led to multiple gaming plays — ranging from core and mid-core studios to RMG, engagement platforms, and tooling platforms — creating immense value and attracting billions of dollars in funding.

India specifically is at an inflection point as deep talent and demand come together. Boasting half a billion gamers and leading the charge in game downloads, India is poised to become the next gaming superpower. The investment in Indian talent by international studios, along with the exponential growth of local studios— 25-fold since 2017 — highlights this potential. Many large domestic outcomes have already materialized, further heightening the appeal of the market. Looking ahead, we expect the Indian gaming market to surge to approximately $10 billion by CY2030, growing at a CAGR of around ~17%.

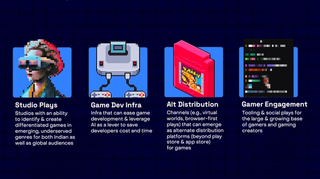

At our recent Gaming Kickstarter, we laid out our thesis on the gaming market opportunity. Beyond the differentiated RMG plays that continue to emerge, we are particularly excited about four forward-looking themes in this space: Studio Plays, Game Dev Infra, Alt Distribution, Gamer Engagement.

If you are actively building in these spaces or have exciting ideas in gaming, feel free to engage with our Gaming team to brainstorm your thoughts. Drop us a line at gaming@elevationcapital.com.

We are excited about studios creating new games in emerging genres, either for Indian audiences or global audiences. Game dev infra that can reduce the cost and time it takes to make games is another area that’s ripe with opportunities. We're also excited by platforms that are building social and engagement tools for gaming-focused creators and streamers, and alternate distribution channels and formats beyond the traditional app stores.

At Elevation, we’ve been active investors in social and content plays, having been early investors in category-defining companies such as Sharechat. Games, which are essentially the highest engagement content format and inherently social experiences, are naturally a space of deep excitement for us.

We made our first gaming investment in 2016 (PlaySimple Games, Series A), and deeply appreciate the intricacies and most importantly the patience required to build a world-class studio. Since then we’ve invested in other gaming companies across verticals including Turnip (next-gen engagement platform for gaming communities), Probo (opinion trading platform) and most recently a casual game studio (stealth). We follow a thesis-first approach and comprise a 6-member team dedicated to gaming.

At our Gaming Kickstarter in Bengaluru on ‘Building The Future of Games’, we hosted a discussion between Mayank Khanduja (Partner, Elevation) and Siddharth Jain (Co-founder, PlaySimple Games) on the nuances of creating a best-in-class casual game studio out of India.

Watch the complete Fireside Chat here.

Vaas Bhaskar (Principal, Elevation Capital) moderated a panel discussion on the evolution of distribution, engagement and monetization in gaming, featuring Nishant Verghese (Head of Meta Audience Network, India), Manish Agarwal (Ex-CEO, Nazara Technologies Limited & Elder Council Member, IndiGG) and Pooja Dubey (Founder, Turnip).

Watch the panel discussion here.

Related

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Plena Data

Automating manual accounting tasks and improving employee experience with robots

14.10.2021

Monetization Strategies That Work: Insights from Consumer Tech Founders

Insights on what works when it comes to monetizing consumer apps in India.

10.12.2024