India Pulse: 2022

We’re all-in on India - for 2023 and beyond

Please click here to download the full report.

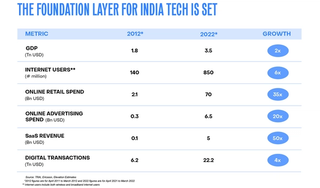

The emergence of India as a tech powerhouse and the world's third-largest economy has been nothing short of remarkable. India has built robust policy frameworks & an entrepreneurial environment enabling it to thrive in a global, digital-first world. While the proliferation of smartphones and access to affordable data ensures social mobility for nearly 900 million people, the Indian government’s focus on building foundational elements of the tech ecosystem is also a key catalyst. Today, 99% of the adult population in India has an Aadhar card - the world’s largest biometric based ID system. The government’s push for online identity (Aadhar, Digi Locker), transactional rails (ONDC) and financial inclusion (through OCEN, UPI) has enabled India to gain significant momentum in the world order.

In this inaugural India Pulse Report: 2022, we want to celebrate India’s steady march upward and highlight the current macroeconomic environment and the reasons we feel extremely excited about India in the longer term. We expect a relatively cautious approach from investors in 2023 as they wait for macroeconomic uncertainty to subside and company valuations to adjust to lower growth expectations.

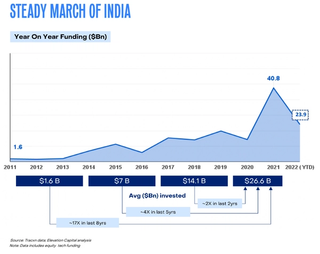

Though we are maybe amidst a ‘funding winter’ right now, a look back at the last decade explains how far we have come, and we believe the future for India tech will be even more exciting. Globally, VC as an asset class has expanded significantly in the last 10 years. India is also a big proponent in this story, especially in the last 5 years, where we have seen explosive growth. USD120Bn was invested in India in the last 10 years and 50% of that was just in the last 2.5 years, making India one of the most robust economies for investors.

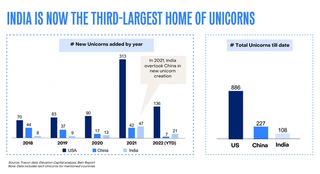

This confidence is well-founded. 2021 was an inflection point in India’s start-up story, reflected by the doubling of its unicorn base, making India the third largest home of unicorns globally. An overwhelming 47 of its 106 unicorns (at the end of 2021) became unicorns in 2021 itself. Unforeseen utilitarian and lifestyle changes induced by the pandemic have accelerated digital adoption in what was already a fast-growing economy. In 2021, for the first time, India has also outpaced China in the absolute number of unicorns created per year. At the current rate, India is on a path to outpace China by 2024/2025 in global unicorn share.

We believe that the fundamentals of the Indian economy are very strong. Low leverage and favourable demographics in India create a long runway for growth. In addition to this, accelerated digital adoption rates combined with deep domestic consumption market with strong growth levers have bolstered the demand and consumption for tech-first products. This makes us believe that Indian start-ups will continue to remain an attractive pool for investors globally and the recent fundraising announcements of the India-dedicated funds bear witness to the significant capital waiting to be productively deployed.

We at Elevation Capital believe that such bear markets produce the best bull companies and remain excited about investments across all key sectors in India.

We continue to remain All in on India!

Related

ixigo IPO: The Long Road To Success

Building for Bharat like no one has

18.06.2024

What If We...Win?

Unlocking The India Consumer Tech Opportunity

24.04.2024

Winning In The AI Market: Creating A Differentiated GTM From Day One

Winning In The AI Market: Creating A Differentiated GTM From Day One

24.06.2024