Marketplaces Unleashed: Fuelling India’s $200B Consumer Spending Surge

Marketplaces Series: Part 1

Marketplaces Unleashed: Fuelling India’s $200B Consumer Spending Surge

Marketplaces Series: Part 1

(This primer on the present state of marketplaces is the first of a multi-part series on our framework to build robust platform businesses)

At Elevation Capital, we’re deeply passionate about consumer marketplaces as a theme, and have had a history of being involved in the various evolutions that the space has undergone in India. From the early Web 1.0 days of listings-based plays such as Justdial, to adapted-for-India plays like MakeMytrip, then Hyperlocal/For Bharat plays such as Swiggy, Meesho and Urban Company, and to today’s vertical marketplaces like Nobroker and Spinny, we’ve been lucky to have had caught these trends at the right time and witness India’s online consumer aspirations unfold.

As the Consumer Tech team, we began reflecting on where marketplaces in India have reached, and this piece is an attempt to share our framework that builders can use as they create category-defining platforms that shape the next decade of e-commerce.

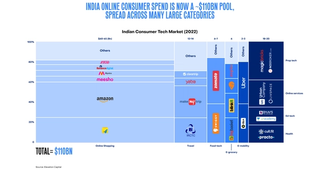

As you are reading the article in 2023, online consumer spend in India is at $110 billion. In the chart above, you see how it is split across various categories and two things stand out:

- Marketplaces capture the major share of the revenue pool, upward of 80% of the spends are directed through marketplaces

- Some interesting players like Reliance Digital, IRCTC, Dominos take up important space; in addition to new age marketplaces

We estimate that the online consumer spend will double over the next three years, reaching a level of $200 billion and will only continue to grow as India marches towards $5000 per capita GDP by the end of this decade.

The Propellers: Unveiling the Drivers of India's Online Spending Surge

Consumer expenditure patterns evolve as the broader economy expands. Every country exhibits distinct consumer expenditure patterns linked to the respective nation's stage of economic development. As a population's average income rises, it becomes evident that the share of spending dedicated to discretionary items too goes up. On the flip side, the expenditure share allocated towards essential commodities subsequently diminishes. To illustrate, households with incomes less than $750 annually tend to allocate approximately 50% of their budget to essentials, which significantly decreases to around 30% when incomes surpass the $2,000 threshold, and contracts further to as low as 20% when the income level exceeds $10,000.

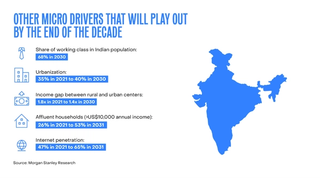

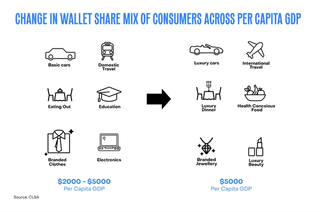

India, currently a $2500 per capita GDP nation and the fastest-growing major economy, finds itself at a fascinating crossroads. Discretionary spending within the country is picking up speed, and we feel that certain sectors stand to benefit substantially from this shifting expenditure pattern. As per CLSA's prediction, the proportion of discretionary spending in India could potentially surge to a staggering 71% by 2030. This interesting correlation between expenditure trends and per capita GDP growth has been highlighted in an analysis by CLSA.

Increase in discretionary spending leads to channel organization. Consumers tend to spend more in organized markets when it comes to discretionary spends. This naturally stems from the ease of access and information, and standardization of systems that organized players tend to offer. Consumers tend to pay a premium for this convenience and we can very well notice these trends play out with the incumbent marketplaces.The next generation of companies and marketplaces targeting these niche segments of consumer interest will spearhead this change further.

The progression seen in the above factors only plays in favor of shifting the consumption spends upwards. Zooming out again, these factors give rise to the changing themes of consumption as certain categories are set to grow at much faster rates than others. As the country hit the per capita GDP mark of $2000 in 2018, we noticed the transition towards a more “affluent” lifestyle marked by gradual increase in expenses towards electronics, branded apparels and personal care. By 2030, the transition would have taken a more concrete shape, with focus indexed towards health, luxury dining and cars, and jewelry. We would recommend you to read this article by ET Retail to learn more about the income and expenditure patterns in India

The Platform Prowess: How Marketplaces Hold the Key to Capturing Exponential Value

Over the past decade in India, marketplaces have redefined standards in industries and reshaped the way consumers purchase online - with companies like Amazon, Meesho, Swiggy, Urban Company, Spinny, NoBroker and MakeMyTrip becoming fairly synonymous with their respective domains. This brings the question, how are marketplaces able to capture such disproportionate value? At the most fundamental level, marketplaces are platforms that connect the two sides of demand and supply in one space. While the nuances of each would be different, we can distill the reasons behind this business model’s transformative ability as follows:

Consolidation and Removing Asymmetry of Information. The growth of any industry invariably attracts a surge of new entrants, each vying to carve out their niche and differentiate themselves from the competition. And as the size grows, so too does the noise in the space and the customers feel the brunt of not being able to discover and compare these unique products. Marketplaces emerge as influential players in this equation that consolidate the supply, establish normative benchmarks, and thus provide more favorable market consolidations.

Lean inventory helps rapid scale up. Most marketplaces initially start out by generating access between the existing players in the industry. With trust and standards being the core proposition they offer, these fixed components help the marketplaces scale up across the breadth of offerings and demand pools at ease.

Negative working capital cycles. Marketplaces that operate without the burden of inventory often benefit from lean cycles of capital flows. They serve as the hub for transactional cash collection, allowing them to accumulate surplus funds in their bank accounts. This surplus cash becomes readily available to support and sustain their ongoing operations. This is a key differentiator for marketplaces and has proven to be the foundation pillar for many large incumbents like Amazon, that although ran in losses in its initial days, had sufficient liquidity in the system. HBR Review has written an excellent article on this and we will recommend you read that for more insights.

Given the above context on the current state of marketplaces, and the positive outlook one can hold for the decade to come, below we capture our framework to build strong platforms:

Stay tuned to the next edition of this multi-part series as we cover each axis of our framework in detail with case studies from companies that have been built fundamentally through these lenses. If you are building in this space, feel free to reach out to anand@elevationcapital.com and manish@elevationcapital.com to share your insights.

Reading suggestions:

- India Consumer Outlook - CLSA

- Why this is India’s Decade - Morgan Stanley Research

- The consumption kaleidoscope: what’s driving the rise in India’s retail sector - ET Retail

- At Amazon, It’s All about Cash - HBR Review

Written by Manish Advani

Related

Harnessing Better Experience And Innovative GTM: Marketplaces Unleashed Part 3

Exploring the last two pillars of our marketplaces framework through case studies

03.08.2023

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Atlys

Building the world’s largest digital visa provider

21.09.2023