Customer Loyalty in the age of Direct-to-Consumer

Understanding customer acquisition for D2C brands

Customer Loyalty in the age of Direct-to-Consumer

Understanding customer acquisition for D2C brands

In the last few years, several direct-to-consumer (D2C) brands, like SUGAR Cosmetics, Country Delight, Indya, BoAt, and Mamaearth have grown significantly by following an online-first approach, while competing head-on with offline incumbents. They are more connected to their customers digitally than ever possible for a brand in the offline world. This connection has enabled them to create brands that resonate with the millennial and Gen-Z consumers. On one hand, the online channel has democratized "distribution" which was (and continues to be) a core moat for all large CPG (consumer packaged goods) companies. On the other hand, companies are finding it increasingly difficult to build customer loyalty. As the barriers-to-entry lower, there is a substantial increase in the number of new brands, leading to D2C channels becoming more expensive to maintain and grow over time.

To create a sustainable consumer business, companies need to tread the balance between growth and the right marketing spend strategically. In this two-part article, we will discuss two key concepts—“New customer acquisition” and “Repeat consumer behavior”. To keep things simple, we will do this through the fictitious “The Skincare Company” (used for illustrative purposes only).

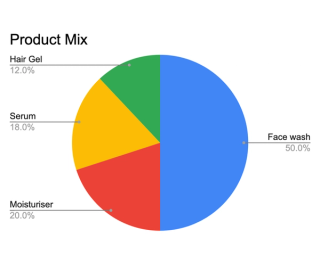

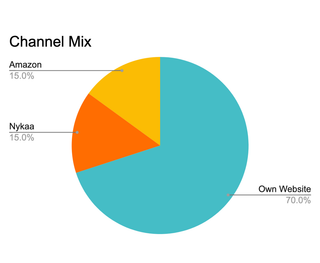

The Skincare Company (TSC) is a new-age skincare brand that uses “watermelon” as the hero ingredient across their products, from face washes and moisturizers to serums and hair gels. The "Watermelon Scrub Face Wash" is a raging success and contributes to ~50% of their revenue. They have focused on Gen-Z women as their target audience and core customers. TSC sells primarily on its own website and has recently ventured into the Amazon and Nykaa marketplaces.

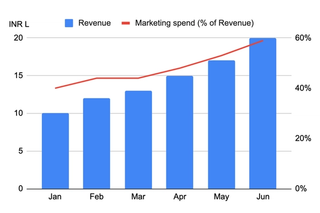

However, there has been an increase in marketing spend since January 2021, primarily driven by customer acquisition on the D2C channel. The team is quite concerned about their marketing spend, which is increasing faster than the revenue growth every month. They have also started to burn cash and are confused about their growth strategy.

The question is — "Where do they stop pressing the marketing pedal?”

Reviewing customer acquisition costs

On further inspection, TSC realized that a large part of their growth is actually from new users and not repeats, contributing to the rise in marketing spends.

They first look at the “Marketing spend per order”. There is an apparent upward trend in this metric month-on-month, which is a clear sign of worry.

“Marketing spend per order” is a useful metric to evaluate the overall strength of the brand, since it combines the effects of both (1) paid marketing to drive new user acquisition & repeats, and (2) organic or direct traffic to the brand. However, given most of the performance marketing effort is towards acquiring new customers, this metric only tells half the story.

Hence, TSC reviews the trend on CAC, that is, the marketing spend for every “new customer” acquired. The marketing spend considered here is only the performance marketing spend targeted at new customer acquisition (effectively taking out retargeting existing users & brand spends). This helps in tracking the effectiveness of performance marketing spends and the degree of organic traffic.

CAC = Performance marketing spend on new customer acquisition / No. of "new" customers acquired

For TSC, the CAC is increasing at a much faster pace. Something is clearly wrong! The founders are looking at the Marketing team for immediate answers.

Assessing reasons for the drastic increase in CAC

According to the Marketing team, the rise in CAC on a D2C channel is a well-known phenomenon that occurs as a result of:

Decreasing rate of conversions on seeing an ad: When a brand starts off, it primarily targets and sells to the early adopters before (progressively) trying to sell to the next fence-sitter, which naturally reduces conversion over time.

Increasing pricing of ads: Given the higher demand for digital advertising, with the creation and rise of new brands, the CPM (cost per 1,000 impressions) on most ad platforms have also increased over time.

While this does explain why TSC is seeing a growth in CAC, the founders are worried that this could gradually make the business unsustainable—and they need an immediate resolution. While their objective is to reduce the CAC, the question is — "What is even the right CAC to target?"

Reviewing lifetime value (LTV) and LTV/CAC

CAC is an upfront investment to onboard a customer, who is expected to be loyal and contribute to revenues over a long period of time. This value from each customer is captured by the lifetime value (LTV), an important metric to evaluate the right CAC targets.

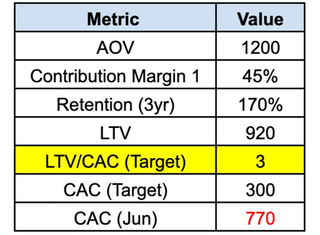

LTV (over x years) = Avg order value (AOV) X Revenue retention in x years (%) X Contribution Margin 1 (%)

AOV: Revenue generated from the new customer on their first order

Revenue retention in x years: Amount of cumulative revenue in x years as a % of First order AOV. For example, if 5 new customers acquired in July spend INR 100 and they end up spending an additional INR 50 over the next 3 years, Cumulative Revenue Retention in 3 years is 150%. (Part 2 of this article will discuss Retention cohorts in detail.)

Contribution Margin 1 - CM1 (%): Pre-marketing contribution margin (Net Revenue - COGS - Logistics/Shipping - Other direct costs) / Net Revenue

To set the CAC targets, the company wants to ensure there is enough return (LTV) on their upfront investment (CAC).

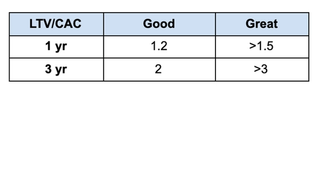

LTV/CAC benchmarks can hence be used to arrive at the right CAC to target. These are generally consistent across product categories. TSC finds benchmarks from other Indian D2C founders who advise them to not compare them with the US brands. This is because of a higher chance of customers repeating with marketplaces in India compared to the US.

Setting a target for CAC using LTV/CAC benchmarks

After looking at the benchmarks, the founders are targeting 3-years LTV/CAC of ~3. TSC is not able to acquire customers at the required CAC of INR 300 to meet the target. They are currently spending INR 770 to acquire a new customer.

While the Marketing team accepts that they need to make changes to their strategy, they also point out that there is significant room for improvement in Retention. The current 3-years retention of 170% is quite low, as compared to other brands in the category that are operating at a rate of over 300%. A part of the low repeats on D2C channels is due to customers repeating on Amazon and Nykaa.

TSC founders mobilize the Marketing team to reduce the CAC and bring it closer to INR 300, while the Product and Customer Support teams figure out the evident gap in customer repeats. As there are strategic benefits of owning customers on D2C channels, the team also wants to double down on keeping repeat customers on D2C against Amazon and Nykaa through remarketing efforts.

Implementing initiatives to keep CAC in check

The TSC marketing team went back to the drawing board, to speak to their customers and study approaches taken by other top global brands. They implemented a few promising initiatives, which helped in reducing and stabilizing CAC.

Partnering with expert skincare influencers: TSC heard from several customers that they began to trust the brand after watching reviews from skincare experts they follow on YouTube. This was imperative since TSC is the first brand in the country to use “watermelon” as its core ingredient. TSC had so far focused its efforts only on Instagram and Facebook. As next steps, they partnered with some of the top skincare influencers on YouTube for promotions and recommendations.

Leveraging word-of-mouth on Instagram: Customers also shared that they saw an instant glow after using the product. Some of them even said they would use it right before taking pictures. Based on this, TSC launched a discount coupon to popularize #watermelonGlow for tagged Instagram posts.

Refreshing creatives at a higher frequency: While looking at conversion rates for their creatives, they realized that all new visuals had high conversion rates initially but would start to drop off after a few weeks. To address this creative fatigue, they decided to expand their design team to develop visuals more frequently.

With these initiatives, the team was able to bring the CAC down from INR 770 to ~INR 500 over the next 3-4 months. This improved their 3-year LTV/CAC from 1.2 to 1.8. However, it still is far from the target of 3 the team had started with.

Learnings on new customer acquisition

- Customer acquisition costs (CAC) tend to increase over time on D2C channels

- CAC is the right metric to assess the efficacy of performance marketing efforts, while Marketing spend per order is more helpful for understanding the overall brand strength

- Staying ahead of the curve on the marketing approach is very important to keep the CAC in control

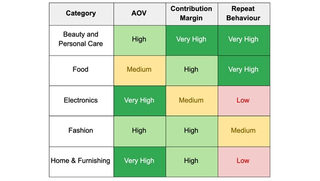

- LTV helps measure how valuable a customer is for the brand over the long-term. The drivers of high LTV differ depending on the product category (as shown in the table) and hence should define the priorities for a brand

- LTV/CAC is analogous to return on investment (ROI) on marketing spends. 3-year LTV/CAC of 3 and above are considered to be great, irrespective of category

- LTV/CAC benchmarks can be used to arrive at thresholds for CAC. Evaluating this metric for a specific category/product also helps in evaluating product-market fit. It can, hence, also help in choosing the right product categories for expansion.

Read Part 2 of the article to understand how TSC addresses the challenge of higher repeats to reach their LTV/CAC target.

Appendix - Initiatives by global brands on new customer acquisition

- BarkBox, a US-based pet treats and accessories subscription noticed that some of their core customers were sharing unboxing of the treat boxes on YouTube and Facebook. They utilized this trend and created discounts for people sharing videos tagging them. They also modified their packaging to ensure maximum visibility of the "BarkBox" brand in the videos. This helped them gain a lot of customers organically through social media in the early days.

- Casper cracked SEO really well to capture a significant share of all mattress related searches. They had one of the best URL ratings (proxy for Google's PageRank) compared to other D2C brands. They did this by creating a customized landing page for all likely searches from users, e.g., "buy mattress nyc" had a specific landing page created on Casper website. They would then bid for the above keywords.

- Glossier is a beauty brand which was built from a community "intothegloss.com" that focused on women talking about beauty. They continued to create communities on other platforms including their Instagram page which has ~2.7 Mn followers today. Their users engage in deep conversations helping Glossier build a strong bond with their customers. ~70% of their sales today come from peer-to-peer referrals.

Written by Chirag Chadha, Mukul Arora, Deepak Gaur

Related

Investing in Plena Data

Automating manual accounting tasks and improving employee experience with robots

14.10.2021

Our New Fund: All In on India

Elevation Capital announces Fund VIII of $670 million, to accelerate partnering with category defining early stage companies in India

07.04.2022

Investing in PierSight

Building the Future of Global-Scale Earth Monitoring

12.01.2024