Investing in Uni

Building feature and experience-rich consumer credit for India

Investing in Uni

Building feature and experience-rich consumer credit for India

It was July 1994. In the US, Signet Financial Corp spun off its credit cards division to create a focused, standalone credit card issuer — Capital One. Their strategy was clear: it would be an ‘information-based lender.’ Credit cards had so far been one-size-fits-all, with flat pricing across customers. Low-risk customers subsidized the cost of high-risk customers. Capital One aimed to test and learn by collecting data to build deep demographic profiles and offer personalized rates — an early ‘fintech’, if you will. Users resonated: over the next decade, Capital One scaled to 50M accounts as the sole vertical player alongside banking behemoths. Today, Capital One has a market cap of $63B and is among the top 5 credit card issuers in the US, offering a full suite of cards, deposit and lending products.

It was May 2013. In Brazil, Nubank was founded as a challenger credit card, up against an oligopolistic banking system that charged brutal fees and had lengthy, broken processes. Cards in Brazil were built on a ‘negative credit bureau’ that punished bad actors but had limited means to identify good actors. Nubank brought in Silicon Valley’s culture of customer obsession and in-house technology to an industry starved of delightful experiences. The distinctive purple card, with no fees and mobile-only processes became viral — hundreds of thousands joined the waitlist. This virality allowed Nubank to build its own credit insights using referral data, unlocking a large, underserved market. Today, Nubank is valued at >$50B and has 48M customers, growing at >100% CAGR — the vast majority still acquired organically.

It’s 2021. India today has a population of 1.4B, with <15% adults being credit-active users. Credit cardholders stand even lower at 35-40M individuals. Credit card penetration in India is <5% - a long distance away from China at >50%, Singapore at >150% and the US at >330%.

At Elevation, we have a few core beliefs on this segment:

1. Neobanks in India will be credit-leaning: access to credit remains severely limited; even among credit-active users, there is a large whitespace for contextual products

2. Card users are heterogeneous: card-first credit plays attract users across multiple value propositions - short-term liquidity, the convenience of bundling transactions and the pull of rewards

3. Building cards is hence as much a brand play as a lending play: winners will combine deep consumer insights and sharp positioning with robust risk management and liabilities build out

We first met Nitin during Uni’s early journey. As we spent time with Nitin, Prateek and Laxmikant, we were convinced this was a team meant to attack this massive opportunity:

1. All three founders come with deep domain expertise, having built and scaled pay later and credit cards at PayU, Bajaj Finserv and Ola Financial Services

2. With this muscle memory, it would be easy for the team to build from their gut. Yet, the one barometer for decisions at Uni is customer voice - the team is obsessive about user behaviour, and deeply iterative and data-driven

3. The goal is to improve customer experience by 10x - by designing, testing and scaling a suite of bespoke credit products for different segments

.jpeg?rect=0,3,6000,3994&w=320&h=213&auto=format)

Uni founders- Laxmi, Nitin, Prateek

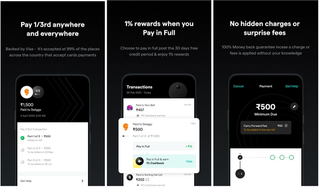

Uni’s flagship product, the Pay 1/3rd Card, was launched in June 21. Pay 1/3rd is India’s first “buy now pay later” card that splits every transaction to thirds, allowing users to pay their monthly spends over 3 months with zero interest charges. Alternatively, users can choose to pay in full at the end of the month and enjoy 1% cashback on spends. The core solve is addressing the nonlinearity in cashflows that users have: large spends are hard to manage within the same month, while the same user may prefer to optimize rewards during times of better liquidity.

In under six months since their launch, Uni is touching INR 175Cr in monthly disbursals. Strong product market fit is evident:

1. Pay 1/3rd sees 2x in monthly spends per customer per month v/s credit card incumbents

2. Users love the flexibility of choosing between normalizing cashflows and earning cashback, and actively switch between the two options - 70% users have transacted on both modes

3. Significantly higher than industry retention - users are making the Pay 1/3rd card their primary payment instrument

4. All this is on the back of tight risk management and nil defaults

This is just the start. Uni is growing 50% MOM, and aims to achieve INR 1500Cr in monthly disbursals over the next 12-18 months. We resonate deeply with Uni’s mission to build a feature and experience-rich consumer financial services brand for India - the bar is set at 10x, and the team will settle for no less! We’re excited to announce our investment in Uni’s Series A and are thrilled to join hands with Nitin, Prateek and Laxmi, and fellow investors General Catalyst, Eight Roads, Arbor Ventures, Lightspeed, Accel and Greenoaks on this journey.

Written by Mridul Arora, Vaas Bhaskar

Related

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Plena Data

Automating manual accounting tasks and improving employee experience with robots

14.10.2021

Monetization Strategies That Work: Insights from Consumer Tech Founders

Insights on what works when it comes to monetizing consumer apps in India.

10.12.2024