The Founder’s Guide To Consumer App Monetization: Part 2

Deep dive into specific consumer monetization models

The Founder’s Guide To Consumer App Monetization: Part 2

Deep dive into specific consumer monetization models

In Part 1 of this series, we explored how the evolution in consumer behavior has fundamentally altered the growth trajectory for a new wave of consumer tech companies, with direct monetization emerging as a $3B opportunity. Now, let's dive deep into specific monetization models and how to implement them effectively.

The evolution of consumer monetization models in India means founders today can find innovative avenues beyond ads to capture value that aligns with user behavior and business DNA. As discussed in the last part, while digital advertising continues to dominate, new-age companies have successfully implemented and scaled alternative models.

In this part, we'll break down three primary monetization models—advertisements, subscriptions, and micropayments. For each, we'll examine the essential business characteristics that make them effective, provide benchmark metrics from market leaders, and share concrete examples of successful implementation.

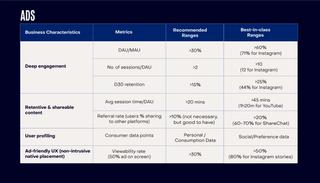

Advertisements

Ads work best for social/content platforms with daily use cases, which want to build a business on a large user base that spends significant time on the app. Ideally, the business should gather rich indicators of users' consumption patterns and preferences to build a strong ad engine. Most importantly, ads must not obstruct the core app experience and should become a native part of the UX.

Case Studies:

YouTube’s Engagement Playbook for High Time Spent per DAU

YouTube has set the gold standard for user engagement, with DAUs spending over 1 hour 20 minutes daily across 5-6 sessions. While a strong first-mover advantage played a role initially, the real game-changer was when it shifted its algorithm to prioritize watch time over view count. This pivot, combined with building the best-in-class creator-earning engine where 55% of net revenue on ads displayed is passed on to creators, incentivized long-form content like vlogs, podcasts, and live streams. Their "Up Next" autoplay feature created content discovery loops, driving users into thematic rabbit holes. The result? A staggering 60% YoY jump in watch time in 2015—their fastest growth rate in years.

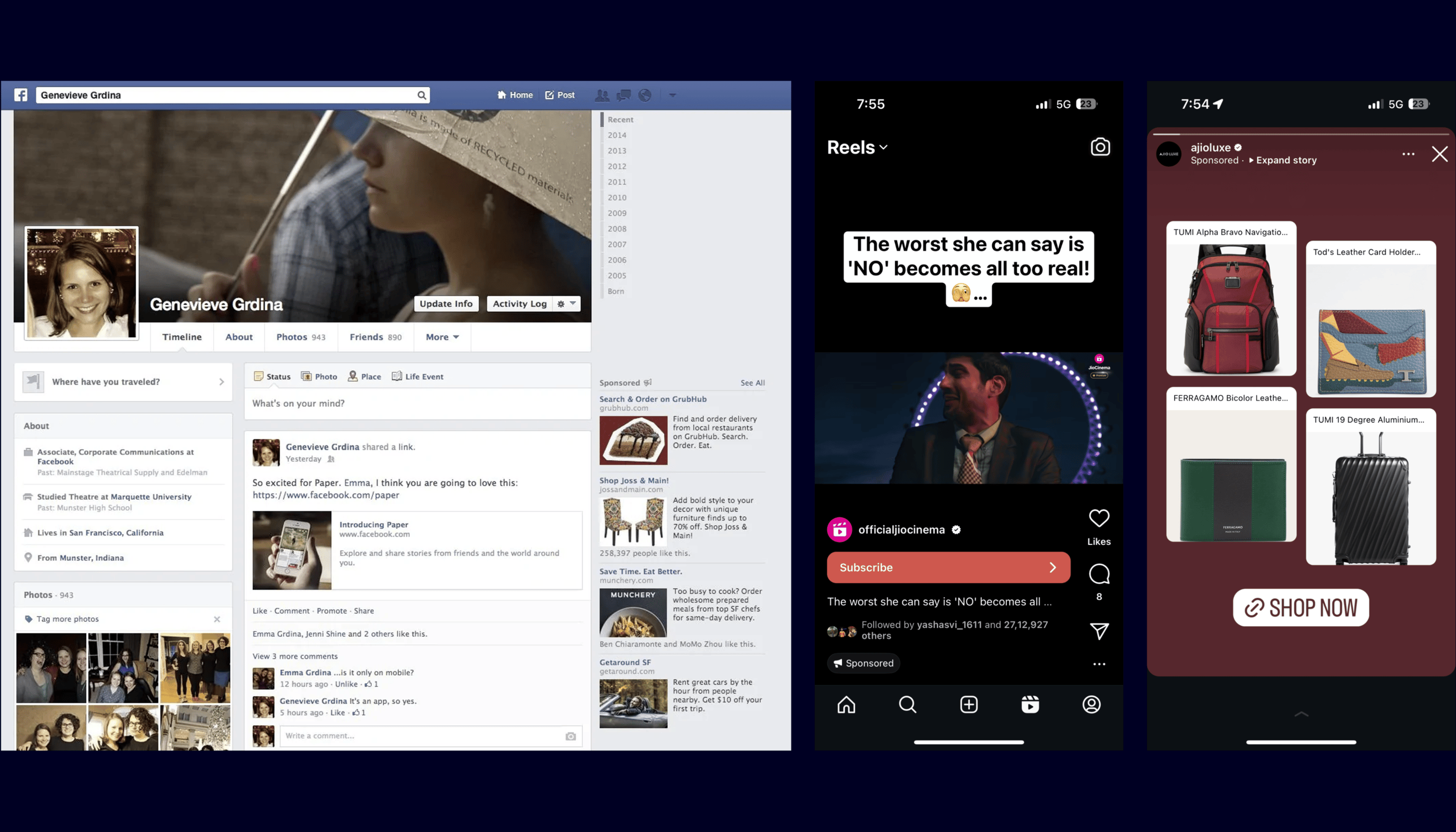

Meta’s UX Evolution To Become Ad-friendly

Meta exemplifies the successful transition from intrusive to native advertising. Their shift to mobile-first experiences, particularly through Instagram Reels and Stories (reaching 500M MAU), enabled seamless ad integration that preserves the core user experience. Sponsored posts now appear natural within content feeds, driving higher CTR and viewability rates, exceeding 80% for Instagram Stories compared to 50-60% for LinkedIn and X, demonstrating how ads can enhance rather than disrupt the user experience.

.png?rect=1,0,2798,1600&w=320&h=183&auto=format)

L: Ads on Facebook feed during its early days R: Ads weaved into Instagram Stories and Reels feeds today

ShareChat’s Bharat Strategy for Shareable Content and TG-specific Stronghold

ShareChat cracked the Tier 2 India market by positioning itself as the "social media app for Bharat," focusing on vernacular content aligned with local cultures, festivals, and trends. They leveraged Indians' desire to share daily greetings and pictures, becoming a primary content source for other platforms, with 60-70% of users sharing daily posts on WhatsApp. This created a powerful growth loop, helping them become one of the few players with a stronghold in the Tier 2 India social media market. This allowed them to reach 350M MAU across ShareChat and Moj, and build a robust ad-monetization engine.

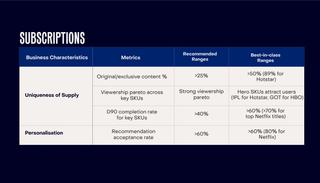

Subscriptions

Subscriptions work best for platforms with unique content that end users are directly willing to pay for. Success typically comes from combining large content libraries with hero SKUs that act as crowd-pullers.

Case Studies

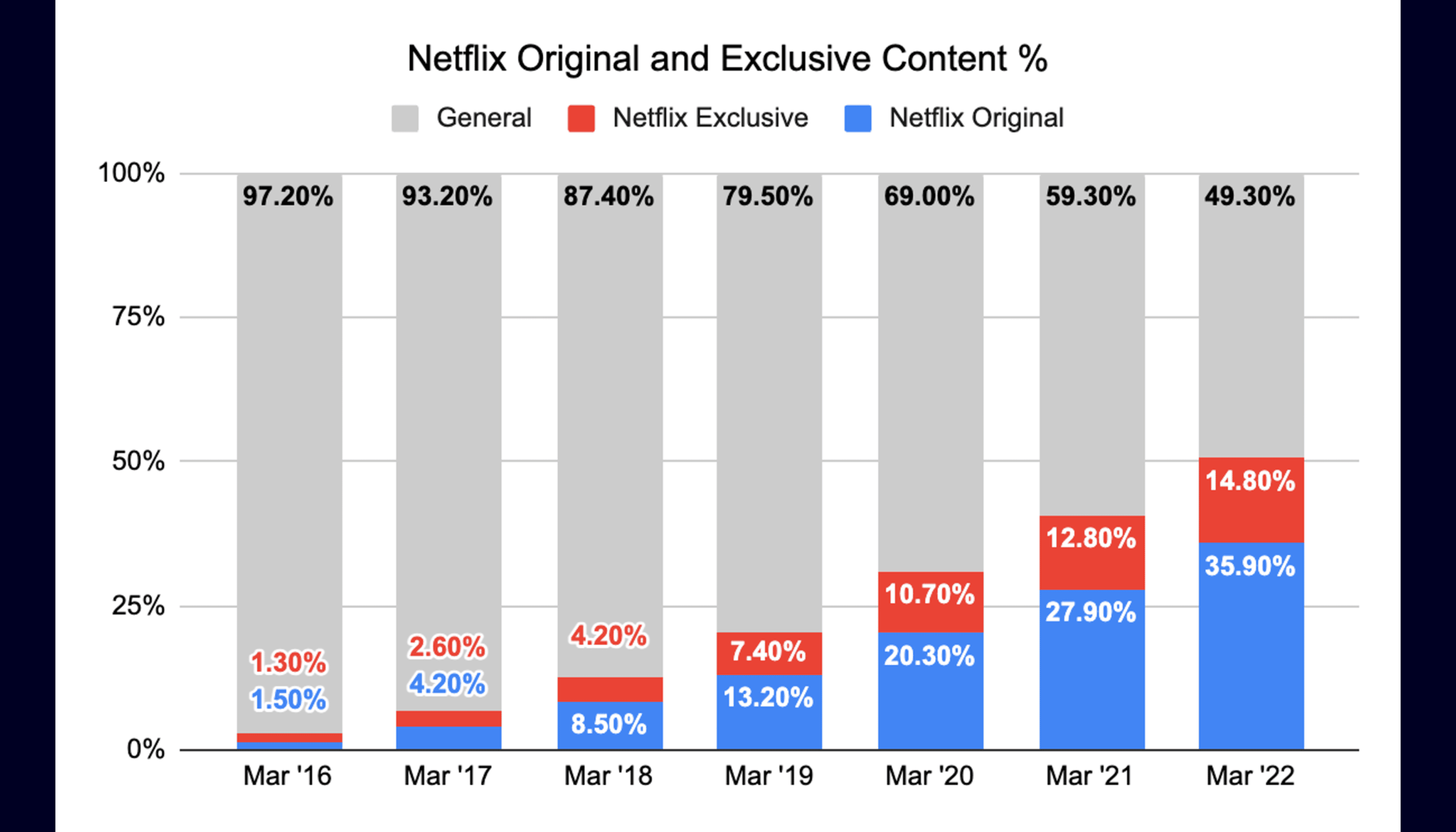

Netflix’s Focus on Originals and Exclusive Content

Netflix's 2007 pivot from DVDs to streaming was driven by the insight that users wanted unlimited access to a large, unrestricted content library rather than be limited to a chosen catalog of movies. Their early-mover advantage helped them secure crucial studio partnerships in the 2010s. Its 2012 Disney deal brought Marvel, Pixar, and Star Wars content to the platform and drew fans of superhero and animated films to become subscribers.

Additionally, Netflix relied on acquiring exclusive streaming rights for popular shows like Friends (a $100M/year deal) and The Office, making it the only streaming platform where viewers could watch these. As new competitors came up and licensing costs increased, Netflix shifted its reliance towards Originals such as House of Cards, Orange Is the New Black, and Stranger Things, which have now become the biggest crowdpullers. This allowed Netflix to continue growing and develop defensibility against newer players. Additionally, Netflix keeps a high bar of 50% completion rate for shows to be renewed for subsequent seasons. Today, originals and exclusives comprise over 50% of Netflix’s content library and 55% of overall viewership.

.png?rect=1,0,2798,1600&w=320&h=183&auto=format)

Source: Backlinko

Hotstar: Large Library and Hero SKUs

Hotstar’s success in India can be largely attributed to its ability to its vast content library and hero SKUs. In 2017, its then-parent, Star India, secured exclusive IPL broadcasting and streaming rights for 2018-2022 for $2.55B, the largest media rights deal in Indian sports at the time. It later acquired streaming rights to ICC tournaments and popular Star network shows like Yeh Rishta Kya Kehlata Hai. Viewership surged during major events and hero SKU releases (59M concurrent viewers during the 2023 World Cup final), and subscriptions spiked 2-3x during IPL season every year. Hotstar's 100,000+ hours of content library and hero SKUs have made it a household name that captures >30% market share in the Indian OTT space.

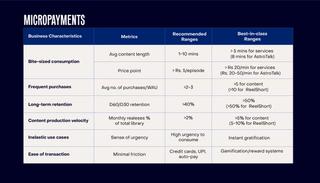

Micropayments

Micropayments work best for platforms with low-priced short-form content in inelastic spend categories like education, religion, astrology, etc. Content on these platforms typically features cliffhangers and provides instant gratification. A key characteristic is the emergence of 'whale behavior', where a small percentage of initial users (5-10%) find product-market fit and stick around, contributing disproportionately (>90%) to total revenue.

Case Studies:

PocketFM’s Engagement Engine

PocketFM offers 10-minute audio operas and dramas with rapid character development and unexpected twists focusing on dramatic themes like rags-to-riches, thrillers, and love triangles—over 70% of its content library. By incorporating hooks, controversial statements in the initial episodes, cliffhangers, and satisfying endings, PocketFM drives user engagement and instant gratification for paying subscribers. A troupe testing engine enables quick content production, using sample clips to gauge interest before launching full series, reducing production time after testing to 3-4 weeks. A strong production engine and insights into genres that provide instant gratification to users have allowed PocketFM to create a strong, paid content library.

Roblox: Digital Assets and Ease of Transactions

Launched in 2006, Roblox surged in popularity during the pandemic and now has around 400M MAU, with users spending an average of 2.5 hours daily. 75% of US kids aged 9-12 use the app. The platform’s free download model and in-app purchases via "Robux" let users buy skins and accessories (from $1 to $600), often without parental consent via platforms like iTunes. This economy supports a unique social structure where exclusive items, like the rare "Dominus Frigidus" hat (sold for 200M Robux, or $2.5M), signal status and creativity. Roblox's diverse purchasable items and accessory layering create a social hierarchy that fuels engagement and spending within its virtual world.

Our View

At Elevation Capital, we're excited about founders leveraging these emerging monetization models to build capital-efficient businesses. The success of companies like ShareChat, Stage, and AstroTalk shows that Indian users are ready to pay for value – whether through ads, subscriptions, or micropayments.

With new forms of direct monetization now picking up, a new wave of social/content companies can get built in India. Short-form video drama platforms, personalized/interactive content platforms and AI companionship platforms are some interesting themes we’re observing.

If you're building a consumer app with innovative approaches to monetization, we'd love to hear from you. The playbook for consumer tech success in India is being rewritten, and we're keen to partner with founders leading this change.

Written by Manish Advani

Related

Harnessing Better Experience And Innovative GTM: Marketplaces Unleashed Part 3

Exploring the last two pillars of our marketplaces framework through case studies

03.08.2023

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Atlys

Building the world’s largest digital visa provider

21.09.2023