Fintech Infra: 10 Themes To Capture A $10B Revenue Opportunity

10 Billion Opportunity

Fintech Infra: 10 Themes To Capture A $10B Revenue Opportunity

10 Billion Opportunity

Overview

- We believe there are multiple tailwinds, and hence a massive opportunity for Indian founders to build large companies in the fintech infrastructure space. Large consumer distribution platforms, clarity in regulations, success of large-scale public infra and adoption of technology by financial institutions have together created the ingredients for a perfect storm.

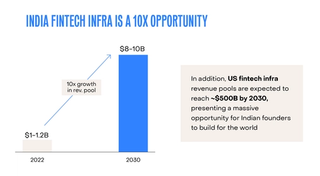

- This opportunity has the potential to grow 8-10x in the next decade, creating a ~$10B revenue opportunity by 2030. Ten themes in this space will accrue value according to us — across BaaS (Banking as a Service), payments, lending, onboarding, fraud, data aggregation/analytics, and insurance infra.

- As founders build infra companies, they will need to start with highly specialized and verticalized use cases/customer personas, have a maniacally high bar on product fidelity and build the muscle to sell to large financial institutions.

With The Convergence Of Multiple Tailwinds, We Are Convinced That Financial Services Infrastructure Is At An Inflection Point

We have been investing in India fintech for the last twenty years and have seen the evolution of the country’s tech, regulatory and financial services landscape from a unique vantage point. As we look back at this evolution and where we are today, multiple drivers become apparent that will accelerate the demand for financial infrastructure.

1. Emergence Of Large Distribution Platforms: By 2030, India will likely have 700M+ users transacting and spending over $500B online. They will transact across multiple large and vertical-focused e-commerce, food delivery, ride-hailing, local services and other online retail platforms. For these users, infrastructure that can embed financial products in their purchase journeys can drive:

- Access: New proprietary data from these platforms can improve access to products to previously underserved and unserved customers

- Efficiency: New revenue streams from financial products can cross-subsidize core offerings and make the platform more affordable for users

- Experience: Embedded and more contextual payments, credit, and insurance

Beyond consumer platforms, small and medium businesses (SMBs) in India are digitizing at an unprecedented rate and remain underserved across financial services. Digitally-enabled merchants are expected to increase to about 75M by 2030. Software products focused on SMBs will naturally have a financial services roadmap that infrastructure products and middleware can enable.

2. Regulatory Measures Driving Clarity: We have one of the most measured yet progressive regulatory bodies (RBI, SEBI, IRDAI), who have taken a balanced approach to consumer protection while promoting measures to drive financial product penetration. We believe regulations will drive clarity on how financial institutions work with tech partners, which accelerates the need for infra and plumbing plays. For example, the recent digital lending guidelines created a need for products to manage the movement of money and data between financial institutions and customers.

3. Rising Competition: As markets get more competitive, financial institutions will need to offer better products and experiences to customers who are used to world-class consumer products. The needs of customers will keep increasing, driving the urgency for quick product development and iteration by these institutions. This will require core and other customer facing products of banks, NBFCs and insurers to be cloud native and built on modern stacks – making them agile and geared for faster product launches and integrations.

4. Increased Adoption Of Public Infra: India has built public infrastructure at an unprecedented pace. The rise and adoption of public infra such as Aadhaar, DigiLocker, Account Aggregator network, OCEN etc., make data aggregation and customer acquisition easier. Enablers and wrappers built on this public infrastructure can help financial institutions drive deeper customer analytics, faster time to market, reduce opex, and improve retention and customer NPS.

5. World Class Talent In India Creates An Unfair Advantage: India is at the forefront of regulations, public and private tech infra, and customer adoption across financial services domains. As you are reading this, world-class talent in India is growing across organizations; this talented pool of operators will be future founders, who can build products and services to win globally.

We Believe These Tailwinds Will Create An $8-10B Revenue Opportunity By 2030

10 Themes Will Capture This Revenue Pool Disproportionately

● BaaS and Payments Infra:

Payments is a rapidly growing (20%+ CAGR) market, across channels (POS, QR and online) and across form factors (UPI, credit card and prepaid cards). Form factors such as credit cards are still at single digit penetration and have immense potential to grow. We believe the growth and innovation in payments will be unlocked by the rapid build up of infrastructure. In our belief, key themes with significant potential are:

- Credit Card Issuer Processors: Infra for banks (small & mid-sized in particular) to issue co-branded cards.

- Payment Orchestrators: Value will be unlocked in improving merchant conversion by orchestrating new payment methods (BNPL & credit on UPI) and improving payment experience (2FA, card tokenization, payment page takeover etc.)

- Verticalized Payments: Infra to support vertical software that will require embedding contextual payment flows (e.g. cross-border, vertical AR/AP, SMBs etc.)

● Lending and Insurance Infra:

Our perspective is that there are opportunities to build lending and insurance products that target both distribution (embedded finance) and manufacturing (core product software)

- Embedded Lending And Insurance: 700M+ retail users will transact online & spend over $500B+ by 2030. In addition, B2B e-commerce GMV is also expected to grow to ~$100B by 2030. This creates enormous growth potential for embedded financial services.

- Credit acts as a lubricant for transaction conversion while improving platform ARPU

- Contextual insurance attach products can be cross-sold to customers in their online purchase journey, bettering customer experience and platform ARPU

We believe that there is enormous potential for full-stack platforms enabling native workflows, manufacturer partnerships and plumbing to embed lending and insurance products.

● Lending & Insurance Infra For Enterprise BFSI:

Banks & insurance companies in India spend <1% of revenues on technology today - significantly lower than their US counterparts (5-10% of revenue). With growing regulatory changes and rising competition, we believe financial institutions will spend more on technology to offer better products and experiences to customers.

- Increasing velocity of new product development and iteration is becoming imperative for manufacturers. This will drive the need to upgrade core systems across financial institutions (cloud native, modern tech stacks/non-monolith)

- In particular, we also believe there exists potential for products that overhaul the credit stack for banks and NBFCs. The core objective being to improve throughput, decrease opex, decrease decisioning time, improve customer NPS and create different skins of credit products.

● Onboarding And Fraud:

In FY22, we estimate 350M+ fresh KYC requests were made across new CASA accounts, lending products, demat and mutual fund products among others. This is expected to grow at 15-20% CAGR going forward. Increased velocity of financial service penetration, alongside the need to balance customer experience and fraud prevention, will lead to value creation across the spectrum

- Global Opportunities: This is a space where we have a strong talent pool in India to build global solutions, especially as alternate data sources and AI create a new wave of behavioral fraud detection companies across geographies

- Orchestrators: Companies operating across jurisdictions and user personas deal with multiple vendors for KYC, AML and fraud management. In addition to orchestration, these products can help enhance risk strategies, back-test and deploy them

- New regulations and data wedges: We expect to see high velocity on this front in India, creating opportunities for challenger companies

● Data Aggregation And Analytics:

Penetration across financial services — lending, insurance, wealth & investing — remains low in India. As new segments of Indians apply for formal financial products, entities will need better access to data and analytics to underwrite and personalize products for customers. The rise and adoption of public infra such as Aadhaar, DigiLocker, AA, OCEN etc., are creating permissioned access to data at an unprecedented scale.

- Enablers Built On Public Infra: Value will be created by aggregation, enrichment, and analytics and insights that help companies profile better, underwrite and recommend products to customers.

Learnings For Founders Building In Fintech Infra

From our experience, we believe the following tenets will be important for success for founders building in fintech infra.

Founders need to start with deep products that build for a specific customer segment or use case. Over time this creates stickiness and capabilities to expand to broader offerings/customer segments.

For example, Sardine ($75M raised) started with device intelligence and behavioral fraud monitoring for companies in crypto, where incumbent providers were slower to develop fraud check modules. Now, Sardine has expanded to KYC solutions, payment transaction monitoring, and checkout enablement modules serving companies across multiple sectors.

Similarly, Middesk ($77M raised) started with KYB for small businesses as a wedge, and hence was able to provide higher coverage vs larger players like LexisNexis for companies who were serving startups. In their initial days, they also co-built with Brex, driving depth of their offering and increased referenceability for other customers.

Companies need to build muscle to sell to enterprise BFSI customers or be able to find fintech sectors with immense growth potential; also, the ability to price by transaction will be a key ingredient to value creation.

For example, Perfios ($155M raised), has scaled revenues by selling to enterprise clients with transaction-based pricing. Their focus on product fidelity ensures trust with enterprise BFSI clients, especially in the credit decisioning stack. Once trust is established, coupled with the right pricing model, scale follows.

Transaction-led pricing can also help companies grow as their customers scale (especially true if you work with fintechs who are fast-growing). For example, Plaid’s ($743M+ raised) Auth & Identity products are used by Robinhood to onboard new customers. Robinhood was an early adopter, and this allowed Plaid to tie up with Robinhood’s growth (7x from 3.3M users in 2018 to 23M in 2022.)

Marqeta with its full-stack issuer processor platform is another great example of a usage-based pricing model that scales with clients. Marqeta’s journey with Block is a testament to how usage-based pricing allows infra providers to partake in customers’ success. Marqeta interestingly even issues options in its own stock to clients, pending usage milestones being hit. A win-win for all parties.

Specifically in India - we are a country where world class public infra has been and will continue to be created. Leveraging and building on top of public infra will be a key unlock for companies.

For example, the Account Aggregator (AA) framework helps with consent-led data aggregation for financial information users. Adoption of AA is rapidly growing since launch in mid 2021, with 7M requests fulfilled (where data has been successfully delivered). Given the data aggregation layer is powered by public infra, value will accrue to players building on top of this - providing analytics or actionable insights on top of this data to enable better and faster decision making.

Our Team

Our Fintech team comprises Mridul Arora, Vaas Bhaskar, Vasudha Wadhera, Kshitij Jayakrishnan, Utkarsh Bajpai, Rahul Humayun, Amit Hegde, Vardhan Shah and Vikram Nanda who have a deep understanding and strong conviction on the fintech infra sector. We’d love to hear from you if you’re thinking of or are building in this space.

Please reach out to us for a chat at rahulhumayun@elevationcapital.com

Written by Mridul Arora, Vaas Bhaskar

Related

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Plena Data

Automating manual accounting tasks and improving employee experience with robots

14.10.2021

Monetization Strategies That Work: Insights from Consumer Tech Founders

Insights on what works when it comes to monetizing consumer apps in India.

10.12.2024