Cents and Sensibilities: Fintech Optionalities For Consumer Tech

A guide to consumer tech founders exploring contextual fintech strategies

“It is a truth universally acknowledged, that a consumer tech platform in possession of a large distribution, must be in want of more optionalities.” - Jane Austen, kicking off a company strategy discussion.

At Elevation, we are privileged to have had a ringside view of the journey of some of India’s largest consumer distribution platforms, such as BookMyShow, FirstCry, Ixigo, MakeMyTrip, Meesho, NoBroker, Sharechat, Spinny, Swiggy, Unacademy, and UrbanCompany - as well as prominent fintech and financial services companies such as Acko, Axio, Clear, Mintifi, NSE, Paytm, and Uni. Across these journeys, we’ve seen various manifestations of contextual financial services and the strong customer pull such products generate.

Today, we believe that consumer tech companies in India are at an inflection point where this 'contextualization' can move beyond pure-play fintech companies to large consumer distribution platforms.

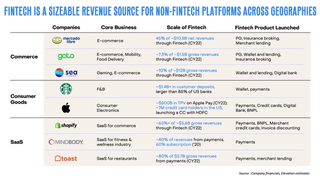

There is evidence of this playing out globally as well.

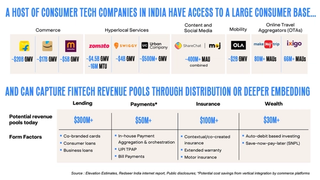

India already has multiple consumer platforms at a significant scale, and projected figures for 2030 indicate that India will have 700M+ users transacting and spending over $500B online. These users will transact across multiple platforms, which would offer significant opportunities for embedding fintech products and garnering a sizeable share of the fintech revenue pool.

Hence, we firmly believe that every consumer tech company must have a fintech roadmap that can add meaningfully to both profitability and engagement/retention of their core consumer business

Finding The Right Products For Your Platform

Below we lay out our thinking on the contexts where some of these fintech products can work best and how to operationalize these. You can also find a handy calculator to estimate the revenue addition from these products here. The fintech revenue should have a direct impact on the bottom line, given its high gross margins.

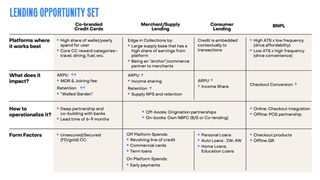

Lending

Co-branded credit cards are the most attractive opportunity amongst lending products. Well-curated programs such as the Amazon Pay ICICI Card have shown industry-leading metrics - scaling to 4.2M+ cards in just over 4.5 years of launch with a 1.2x higher spend per card than the industry average. 65% of Amazon Pay ICICI cardholders had not previously banked with ICICI. Observing this, Indian banks are now keen to partner with more such platforms. By partaking in a share of MDR (1.5-2%), platforms can monetize not just the customer spends on their own platform but off-platform spends as well, which averages ~$22-$24k/year in India.

Merchant lending on commerce platforms and supply-side lending on gig economy platforms are proven products. While an SMB/gig economy TG has long been served by fixed tenure products (term loans), consumer tech firms sitting in repayment/earnings flows are uniquely positioned to offer flexible products such as revolving lines of credit and realize a significantly better adoption.

Consumer lending today is an early opportunity where platforms need to evaluate the pull/attach that they can garner from lending and their unique right to win. However, given the credit-starved nature of the Indian market, origination/lead generation partnerships can be considered an ARPU expansion opportunity.

BNPL is a hygiene feature present across all checkouts, providing convenience to low-ticket/high-frequency purchases and affordability for high-ticket purchases.

Payments

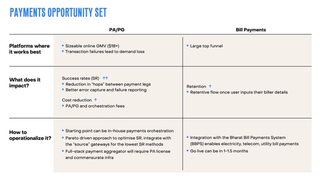

Scaled-up consumer tech companies such as Zomato (~$4.5B GMV), Ola (~$2B GMV), and Amazon India (~$17B GMV) have undertaken the journey of building an in-house Payment Aggregator (PA) and applying for the PA license. While building an in-house PA requires a sizeable investment, a low-hanging fruit to optimize success rates can be implementing the recently launched UPI merchant SDK product. The integration allows the platform to create a UPI VPA exclusively for use on the platform and increases UPI success rates. Given the prominence of UPI in the share of small ticket online transactions today (50-70%), this can meaningfully impact checkout conversion.

The advent of the Bharat Bill Payment System (BBPS) in India commoditized the bill payments product, and today, all large fintechs operate it at minimal take rates. However, we believe the product justifies itself for a platform with a large top-of-the-funnel and can be a valuable retention lever given the highly sticky user journey.

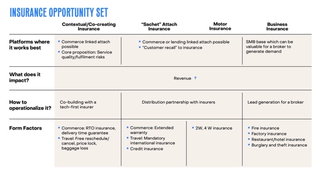

Insurance

While most insurance products are highly consultative and distributed through human intervention, we believe there are a few contextual form factors to insurance that can provide high gross margin revenue as well as improve customer experience/conversion.

Globally, there are large tech-first insurers who have worked deeply with new-age consumer distribution platforms to co-create contextual and sachet products. The biggest example is ZhongAn, which was incubated by Alibaba, Ctrip, and Tencent and has the widest variety of products ranging from insurance against grocery freshness, beauty product allergies, and material quality. In India, Acko leads the way by working closely with Amazon to co-create contextual insurance products across a spectrum of e-commerce verticals. We believe more platforms can critically examine their user journeys and deeply co-build a variety of products through such partnerships.

Motor insurance (2W, 4W) is an ideal product for unassisted sales due to its widespread customer familiarity and deep market penetration. Policybazaar has proven the unassisted sales model among fintech platforms, with 99% of 2W insurance sales in FY22 being unassisted and 56% of 4W sales being unassisted. Similar journeys embedded with commerce (accessories, servicing) can be envisioned on consumer distribution platforms.

Business insurance is a small but fast-growing market in India, with products like fire, burglary, restaurant, and factory insurance seeing increased salience. Given the high touch and consultative nature of business insurance, the most practical form factor might be to partner with brokers/manufacturers and serve as a referral channel for them.

Wealth

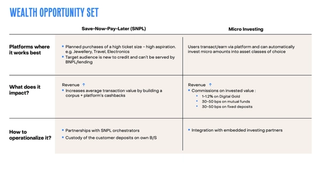

A Save Now, Pay Later (SNPL) construct allows customers to deposit monthly amounts towards a desired purchase (travel packages, gift cards) for a fixed amount of time. Upon completion of the duration, the platform tops up the amount with some additional incentive. In the longer term, this can also be thought of as a gradation journey for customers, where a new to credit (NTC)/thin file customer can be nudged to show good behavior by saving and then given access to unsecured credit products.

Platforms sitting in earnings/transaction flows are also uniquely positioned to offer users features to set up auto-debit-based investing flows across customers’ preferred asset classes. A platform can leverage its brand affinity to create a savings habit and increase retention and ARPU by creating user journeys to invest in liquid and simple-to-understand asset classes.

Three Things To Keep In Mind When Considering Fintech Optionalities

As a founder thinking of expanding their business with fintech, we believe there are three key things to keep in mind:

1. Start planning early: Lots of products take significant lead time given banking/regulatory/tech requirements and then further optimizing and achieving fit within a non-fintech context.

2. Leverage India’s infra ecosystem to shorten time to market: India has a burgeoning fintech infra ecosystem ranging from co-branded card stacks and embedded lending to insurance players and SNPL infra platforms. Leveraging them can help founders accelerate time to market.

3. Over-index on compliance and regulations: Indian regulators have become more proactive over time. Hence, it is crucial for founders to be compliance-first in their approach and only work with entities in the ecosystem who imbibe a similar philosophy.

We trust you found this article instructive. We’ve also written more about how we believe embedded financial services infrastructure for these platforms will become a large opportunity here. If you are actively building in this space or are intrigued by the perspectives shared in this article, feel free to drop us a line at fintech@elevationcapital.com.

Related

Harnessing Better Experience And Innovative GTM: Marketplaces Unleashed Part 3

Exploring the last two pillars of our marketplaces framework through case studies

03.08.2023

Investing in Atlys

Building the world’s largest digital visa provider

21.09.2023

Investing in AppsForBharat

Bringing people closer to their faith and spirituality digitally

02.09.2021