Investing in Loop Health

Reimagining primary care and health insurance in India

Investing in Loop Health

Reimagining primary care and health insurance in India

“I had never tried a healthcare app before… now I trust Loop Health to care for my whole family.”

“My colleagues and I got together to personally thank our HR for introducing Loop to us.”

“My wife is pregnant and sometimes experiences pain in her abdomen. With Loop, we are able to immediately speak to a specialized doctor and get advice. Our medical advisor helps guide us to the right specialist – at any time.”

“We would push our CEO to ensure we’re partnered with Loop for years to come.”

Remember the last time you had a healthcare issue? Remember the frenzy of finding reliable medical advice in good time, the anxiety of the wait? Remember the reams of paper, the multiple documents and the sheer frustration of filing a health insurance claim?

Loop Health is reimagining primary care and health insurance in India.

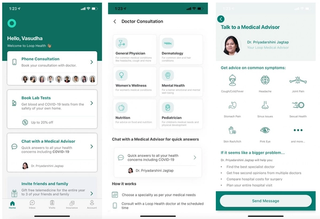

Loop partners with modern companies to provide group health insurance plans to their employees, bundled with instant, free primary care. Each member is assigned a dedicated medical advisor for themselves and their family and can consult Loop’s panel of experienced doctors over the phone or video within minutes. There is guidance along the entire healthcare journey— across consultations, discounted test booking, planning hospitalization and making claims.

Loop makes healthcare reassuring.

Today, only 10% of the Indian population is covered by health insurance (excluding public sector schemes) leading to >60% of healthcare expenditure being out of pocket. However, premiums have been growing rapidly, at a CAGR of ~20% over FY15-20. Within this, the employer-channel (group policies) has been the fastest growing segment, at a ~24% CAGR over the past 5 years to stand at $3.5 Bn in FY20. COVID-19 has accelerated this adoption, with companies increasingly seeking to provide comprehensive care to their employees.

However, group health insurance by itself is insufficient. Employees typically have limited knowledge of the benefits their group policy provides. Usage ends up being episodic, linked to when a claim has to be filed. Even at the claims stage, assistance can be limited and employees often end up using out of network hospitals and spending out of pocket. Therefore, despite being offered with the best intentions, traditional health benefits end up being used by only 6-8% of employees. There is limited impact on employee satisfaction and the ROI on this spend is hard to discern for HR.

Loop’s key insight is that providing primary care is essential to a health benefits plan. Primary care improves the quality of the care journey, as well as lowers costs by reducing hospitalization. HRs see real value in adopting Loop—with 40% of the employee base consulting a Loop doctor within 3 months on the plan.

We first met Mayank and Ryan in 2018, and their passion for solving for healthcare in India—user-first, first-principles, ground-up—was palpable. Joined by Amrit and Shami, Loop’s mission is powerful: building a managed care plan for India, where all incentives are aligned towards improving health outcomes for members. This is reflected in the deliberate design choices the team has made: building an in-house medical team to control quality, making unlimited consults free for members, and ensuring healthcare access is “always-on”.

In the last 12 months, Loop has scaled rapidly to provide empathetic and accessible care to a 50,000-strong member base across 150 companies, growing 50% month on month. The team’s deep expertise in healthcare and insurance also drives industry-leading claims acceptance for its members, leading to strong employer and employee NPS.

This is only the start. By the end of 2022, Loop aims to cover one million members, creating custom insurance and healthcare products, tailored to their member base, with improving health outcomes at their core. We couldn’t be more thrilled to join hands with this mission-driven team, as well as our co-investors General Catalyst, Khosla Ventures, YC Continuity Fund, Tribe Capital, to help employees live healthier and happier!

Written by Mayank Khanduja

Related

Vridhi: Reimagining Home Lending For Bharat's Self-Employed

Ram Naresh Sunku, Co-founder, Vridhi Home Finance

11.12.2024

Investing in Plena Data

Automating manual accounting tasks and improving employee experience with robots

14.10.2021

Monetization Strategies That Work: Insights from Consumer Tech Founders

Insights on what works when it comes to monetizing consumer apps in India.

10.12.2024